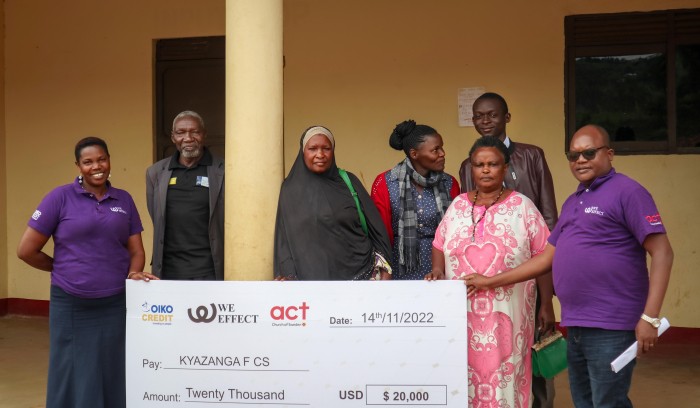

Cultivating Prosperity: Kyazanga Farmers' Cooperative Society Leverages IFIL Loan for Substantial Growth

07 juin 2023

07 juin 2023 In the heart of Uganda, a thriving agricultural cooperative not only cultivates maize, beans, and coffee but also reaps a bountiful harvest of success.

The Kyazanga Farmers' Cooperative Society has witnessed remarkable business growth and enhanced profitability, thanks to the Innovative Finance for Improved Livelihoods (IFIL) project and the support of Oikocredit International Support Foundation (ISUP). As a non-profit foundation, ISUP mobilizes grant funds to aid Oikocredit in its diverse activities within low-income countries, while also providing valuable assistance to Oikocredit's partners in those regions.

Oikocredit, a global cooperative and social impact investor, has long been committed to empowering marginalized communities through sustainable finance. Its partnership with IFIL is a significant stride in its mission, as they together provide loans to small cooperatives like Kyazanga, fostering financial inclusion and bolstering resilience among the rural farming communities.

Beatrice Ruheesi, a steadfast farmer within the cooperative, appreciates the difference that the IFIL loan has made. "The loan through IFIL has given us the needed boost to expedite our business expansion," she says.

Ruheesi, who has dedicated three decades to cultivating maize and coffee, recounts the struggles her small cooperative faced when attempting to secure loans from traditional financial institutions. The arrival of IFIL's financial support has been transformative. "The strict demands of banks were burdensome for small-scale farmers like us. The loan from IFIL has catalyzed our profits," she explains.

Her story mirrors those of many other farmers who have received loans through IFIL since the project was launched last year. Farmers who had previously been unable to secure such financial aid welcomed this lifeline, particularly in these challenging times of escalating production costs and persistent droughts.

Guiding these loans to fruition are Elikanah Ng'ang'a, Oikocredit's Social Performance and Capacity Building Officer for Eastern Africa, and Geoffrey Musyoki, Oikocredit's Investment Officer at the Kenya office. Despite their considerable experience in the financial sector, the opportunity to work directly with cooperatives like Kyazanga offers them novel insights.

"The success of the Kyazanga cooperative has been truly inspirational," Ng'ang'a comments. With the sustained resilience amidst the current food crisis in East Africa and their effective investment in local maize production, the cooperative has indeed earned their respect and admiration.

Geoffrey enthusiastically shares, "Oikocredit brings a wealth of experience in financing farmer-based organisations (FBOs) from around the world, which allows us to identify risks and propose mitigating interventions. The IFIL program specifically targets FBOs that have either never borrowed before or have faced challenges accessing funds from local lenders. These FBOs are often considered high-risk due to weak governance, financial management, and internal controls. The flexibility and innovation of IFIL enable us to provide tailored capacity training and loans that meet the unique needs of each farmer-based organization and cooperative. Unlike traditional financial institutions, which would likely reject lending to these organizations, we can analyze and address their actual needs in a more innovative manner." This project has expanded Oikocredit's horizons by increasing the uptake of financial services.

Archive > 2023 > juin

- 29 juin 2023 - Oikocredit leads US$ 2.5 million extension funding round for Uruguayan fintech partner Bankingly

- 27 juin 2023 - How impact investing can bridge the MSME funding gap

- 22 juin 2023 - Oikocredit and Ueno join forces to promote Paraguayan women’s empowerment

- 16 juin 2023 - Oikocredit holds 47th annual general meeting

- 15 juin 2023 - Unaitas: 30 years of impact investing for success

- 12 juin 2023 - Enhancing our mission: Mirjam 't Lam on the new way to invest

- 07 juin 2023 - Cultivating Prosperity: Kyazanga Farmers' Cooperative Society Leverages IFIL Loan for Substantial Growth